Municipal Assessor's Office

“Whenever you’re in a position to help someone, be glad and always do it, because that’s God answering someone else’s prayers through you. Do unto others as you would have them do unto you”.

Office Adopted Motto

Vision

A proactive and efficient realty assessment services with a main goal of ensuring the taxpayers with effective systems and procedures for their satisfaction.

Mission

To implement innovative changes in systems, policies and procedures provided by law in order to generate sustainable revenues from realty taxes with minimal cost to the LGU and with due care and convenience to taxpayers and the clientele.

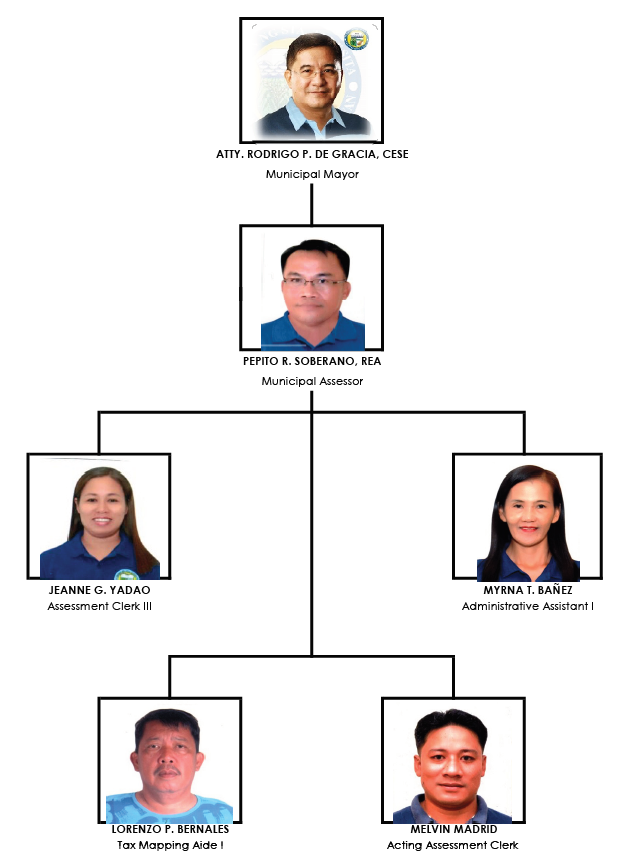

Organizational Structure

Functional Statement

I. STRATEGIC PRIORITY

A. Appraisal and Assessment of Real Property

1. Appraise and assess real properties requested for transfer, revision or declare for the first time;

2. Check and verify documents presented for verification in the assessment records;

3. Compute the transfer tax and verify the authenticity of all submitted documentary requirements as attachment in the transaction;

4. Conduct ocular inspection of real property subject for reclassification and declared for the first time. Prepare and sign ocular Inspection reports;

5. Prepare Field Appraisal and Assessment Sheet (FAAS), Tax Declaration and Notice of Assessment of Real Property (NARP) for processing and approval of the Provincial Assessor;

6. Review all entries in the FAAS, Tax Declaration and verify all attached documentary requirements prior to its recommendation and transmission to the Provincial Assessor’s Office;

7. Issue approved owner’s copy of Tax Declaration with NARP to clients.

B. Assessment Records Management.

1. Compile all approved FAAS and Tax Declaration per barangay. Update and maintain Tax Map Control Map (TMCR), Ownership Record Card, Assessment Roll and cancel all overridden TDs;

2. Prepare, certify and issue copies of requested Tax Declarations, Property Holdings, Certificate of No Real Property and other pertinent records as per Data Privacy Act of 2012;

3. Prepare and certify whether there is No or WITH improvements of real properties based on records.

C. Technical Guidance to all Clients.

1. Provide information and respond all queries of clients on real property appraisal & assessment and educate them on how to process the transfer of their land titles;

2. Assist clients who will come to verify their property location in the section maps;

Support Functions

1. Participate in the Tax Information Education Campaign during the conduct of scheduled animal branding and field tax collection of the Treasury office and during the Synchronized Barangay Assembly Meetings (SBAM);

2. Implement recommendations made by the BLGF Assessment Evaluation Team for the improvement of the assessment operations of the LGU;

3. Prepare and serve Notice to Declare to owners of new improvements within the municipality.

On-going Programs/Activities

1. Facilitate the processing of the transfer of all LGU owned properties and newly acquired properties with available funds;

2. Establish proper coordination with DAR, DENR, ROD & Provincial Assessor’s Office regarding the updates of properties within the municipality;

3. Conduct correction thru simple revision of mixed use into predominant use properties in preparation in the RPT computerization system.

Submission of Reports and Other Functions

1. Prepare and submit 12 Monthly Reports & 4 Quarterly Reports (QRRPA/ESRE);

2. Conduct quarterly staff meeting;

3. Prepare & submit OPCR/IPCR semi-annual plans and accomplishments;

4. Attend webinars and virtual meetings & trainings.